What are Capitalization Ratios?

Capitalization ratios are important metrics used by investors, creditors, and analysts to assess a company's financial health and viability. These ratios provide insights into the company's capital structure, its ability to generate profits, and its capacity to meet its long-term obligations.

In this article, we will explore what capitalization ratios are, how they are calculated, and what they indicate about a company's financial position. We will also discuss the significance of these ratios and how they can be used to make informed investment decisions.

What are Capitalization Ratios?

Capitalization ratios measure the proportion of debt and equity financing in a company's capital structure. These ratios provide insights into the company's ability to meet its long-term obligations and its overall financial stability.

There are different types of capitalization ratios, including the debt-to-equity ratio, the total-debt-to-capitalization ratio, and the long-term-debt-to-equity ratio. Each of these ratios uses different financial metrics to measure a company's capital structure and financial viability.

How are Capitalization Ratios Calculated?

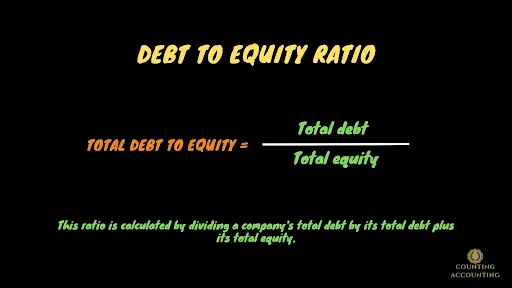

The most common capitalization ratio is the debt-to-equity ratio. This ratio is calculated by dividing a company's total debt by its total equity. The resulting ratio indicates the proportion of debt financing in a company's capital structure.

Total-debt-to-equity ratio: This ratio is calculated by dividing a company's total debt by its total debt plus its total equity. This ratio provides a more comprehensive picture of a company's capital structure, as it includes both debt and equity financing.

Long-term-debt-to-equity ratio measures a company's long-term debt relative to its total equity. This ratio is calculated by dividing a company's long-term debt by its total equity.

What do Capitalization Ratios Indicate?

Capitalization ratios provide insights into a company's capital structure, its ability to generate profits, and its capacity to meet its long-term obligations. A high debt-to-equity ratio indicates that a company has more debt financing than equity financing, which may increase its financial risk.

On the other hand, a low debt-to-equity ratio indicates that a company has a lower level of debt financing and a higher level of equity financing. This may indicate that the company is more financially stable and has a lower risk of defaulting on its long-term obligations.

A high total-debt-to-capitalization ratio indicates that a company has a larger proportion of debt financing in its capital structure. This may increase the company's financial risk and reduce its ability to obtain additional financing.

The long-term-debt-to-equity ratio provides insights into a company's long-term debt relative to its equity. A high long-term-debt-to-equity ratio indicates that a company has a higher level of long-term debt, which may increase its financial risk.

Why are Capitalization Ratios Important?

Capitalization ratios are important metrics for investors, creditors, and analysts to assess a company's financial health and viability. These ratios provide insights into a company's capital structure, its ability to generate profits, and its capacity to meet its long-term obligations.

Investors can use capitalization ratios to make informed investment decisions. Companies with lower debt-to-equity ratios and lower total-debt-to-capitalization ratios may be more financially stable and have a lower risk of defaulting on their long-term obligations. These companies may be attractive investment opportunities for investors seeking lower-risk investments.

Conclusion

Capitalization ratios are important metrics used by investors, creditors, and analysts to assess a company's financial health and viability. These ratios provide insights into a company's capital structure, its ability to generate profits, and its capacity to meet its long-term obligations. Investors can use capitalization ratios to make informed investment decisions.