What is Accounting Cost?

Accounting costs are the value for money produced to get benefits or services. The costs that are not fully consumed are reported in the balance sheet and the costs that are consumed are recorded in the statement of comprehensive income.

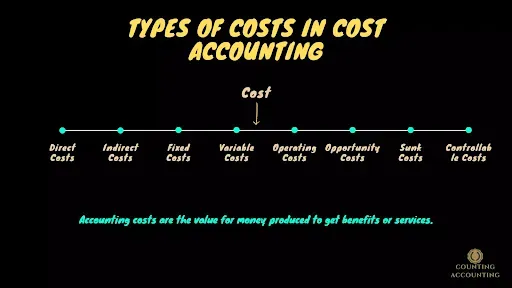

Types of costs in cost accounting:

Costs can be classified into four categories:

- Fixed cost

- Variable cost

- Operating costs

- Direct costs

- Indirect costs

Fixed cost

Fixed cost is the cost that does not change with the production level. Fixed costs are not related to the production or sale level. Fixed costs must be paid on time and have a good effect on the profitability of a business. It can be spread over a specified period of time.

Fixed costs on BEP calculation

To calculate the break-even point fixed cost is an essential element. We can calculate whether a company will make a profit by calculating the break-even point. We know that we can reduce production costs by spreading the fixed cost over the period.

Breakeven Point = Fixed Costs ÷ (Sales Price per Unit – Variable Cost per Unit)

Variable cost

Variable costs are the element of cost that change with the level of production and sale. If the production level increases variable cost increases and when the production cost decreases variable cost decreases. Raw material cost is an example of variable cost if we need to produce more products, that would need more raw material expenses.

Operating costs

Operating costs are the costs related to the day-to-day activity of a business. A common example of operating costs is COGS and SG&A which are selling, general, and administrative expenses. To calculate operating costs there is a simple formula:

Operating cost=Cost of goods sold+Operating expenses

Direct costs

Direct costs are easily traceable in the product. Direct costs are mostly variable costs. We don't allocate direct costs to a product or other cost object as direct costs are easily traceable.

Indirect costs

Indirect costs are not directly traceable in the product. We allocate indirect costs to the different cost objects. An example of indirect cost is the electricity to power up a machine as the electricity is used to produce all the products.

Tags:

Cost Accounting