A wraparound mortgage is a type of seller financing, the person selling the home pays the early mortgage payments, and later these payments can be paid by the new buyer of the home. So the seller still owes money to the bank on their mortgage that's actually gonna remain intact and they're gonna keep making payments on it and then the new mortgage which is going to be extended from the seller to the buyer that's going to wrap up around.

Example of wraparound mortgage

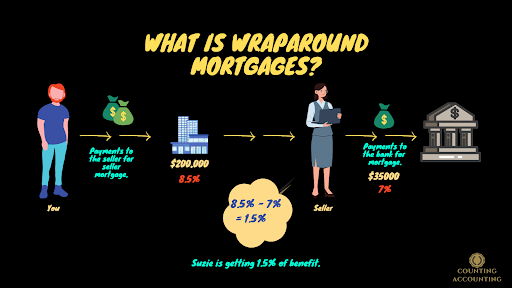

Let's actually show an example that will make it a little bit easier for you to understand. Let's say you want to buy a home from Suzie. You want to pay $200,000 for this home that's what you think it's worth. Let's say Suzie has an existing mortgage. She borrowed money to buy that home and she still has $35000 left on that mortgage.

So normally what would happen is you would go to the bank and you say "I need $200,000 dollars so that you can buy this house from Suzy." Then Suzy would take that money because she's getting paid all this $200,000. She would take that and then pay off her own mortgage. So her mortgage is gonna get completely paid off, she's gonna use the proceeds from the sale of the house but let's say that you can't get money from the bank. Let's say that there's some kind of issue the bank won't loan you money for whatever reason. You decide that you can get financing from Suzie.

Suzie will be willing to lend me this money. Now Suzie's not actually going to give you the $200,000. I mean it's silly right? Starting to give you $200,000 and then you just give her $200,000 back. What Suzie's actually gonna do is she conveys the title of the home to you and she extends a mortgage or gives a mortgage and she's giving you a loan and that's that $200,000 at the 8.5% interest.

Advantages of wraparound mortgage

Now, what's the advantage to Suzie of doing this? Why is Suzie going to say hey you don't have to pay me the whole amount up front you can just go ahead and I'll finance this and you just make payments to me?

Well, maybe Suzie was having a hard time selling her house. Maybe it's kind of not a good market for people like you to get credit. So Susie wants to sell her house faster and she just decides that you will help her to sell her house faster and she wants to move into her other home. In addition to that, if there are rising interest rates, there's also another benefit for Susie. That benefit is Susie has an existing mortgage of $35000 with 7% Interest. Now Susie is continuing to pay her mortgage. She's not gonna extinguish her mortgage because she doesn't have $35000 to just pay this off.

So her 7% interest rates have gone up and she's getting 8.5% interest. So she's got a spread because she's still making payments on her existing mortgage.