What is Negative Amortization?

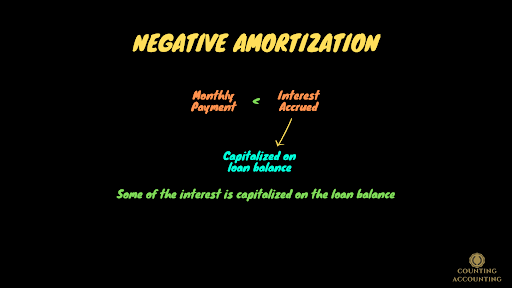

Negative amortization is something that happens with loans. So it's when you borrow money and if for some reason your monthly payment is less than the interest that you occurred for that month or for that period, then you're actually going to have a situation where your loan balance (at the amount due) is actually going to increase. The reason is that some of the interest is capitalized on the loan balance.

Example

Let's just think of it like this if you have a student loan of $40000 and so you incur $500 of interest during the period. But the payment that you make is only $200. Well, your payment didn't even cover the interest that was due so you've got $300 here. Now you're gonna add that $300 and you're going to pay all $40300. We call it negative amortization because normally when you have a loan you're amortized or paying down the balance you're paying down the balance till it gets to zero.

Why Negative Amortization?

Now you might say this is silly, why would there ever be a loan that's constructed where the balance is actually growing larger? Well in some cases obviously if you just can't make the payment you work out some kind of thing with your lender and in the temporary short-run you might think well maybe that's a reason but sometimes loans are specifically designed to do this. There's some logic to it I'm not saying that it's always a good idea when someone has along with negative amortization but for example, if you have an (ARM) loan an Adjustable-Rate Mortgage, or if you have a Graduated Payment Mortgage (GPM), both of these types of mortgages you might be in a situation where in the early years of the loan you have a smaller mortgage payment because maybe you have less income during this periods.

So now you just had a child you've got some expenses but in the next few years, we see that you're gonna have more income. So we think that you're gonna have more income and so we'll give you this graduated-payment mortgage. Where even though you've got for the first few years your loan balance is actually increasing it's actually because your payment isn't sufficient to cover the interest, that's gonna help you get into a house now and then when you have a higher income the payment is gonna be higher. That's what we call a graduate of payment.