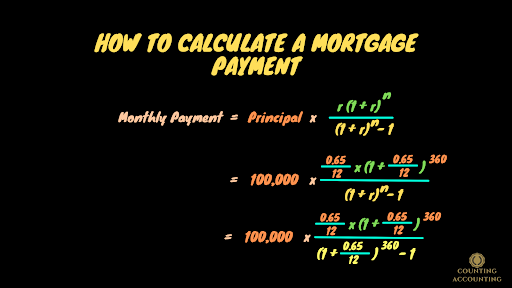

We have a really nifty formula that we can use to calculate mortgage payments. So the monthly payment that's due your mortgage payment is going to be equal to the principal that's how much money you're borrowing.

Mortgage Calculation Formula:

If you're borrowing principal and you're going to multiply it by a fraction. So in the numerator and the top of this fraction, we've got (r). This (r) is actually going to show up several times. This (r) is actually the interest rate that you're paying, so the APR is the Annual percentage rate. We have to divide that by 12. Why? Because we're making monthly payments. So we take the interest rate divided by 12, and we multiply it by (1 plus r) to the n'th power. That (n) is an exponent.

Now that n also represents something that is the number of payments that you're going to be making. If you make a payment every year then you have to multiply that by the month. So if you have 30 years loan, then you're gonna have 30 years multiplied by 12. 12 months in a year. So that would be 360. And then a denominator does have that 1 plus R to the nth power and then we subtract 1.

If we follow this formula here that's going to yield our monthly mortgage payment. Now we're not going to think about property taxes or other things that might be lumped in with the mortgage payment, we're just going to think about repaying the principal and the interest.

Example:

Let's say that you borrow $100,000 at a 6.5% annual percentage rate (APR) to be repaid over 30 years. Now we want to say, "what would be the monthly payment?" So our monthly payment it's going to be equal to our principal which is $100,000, that's how much money we're borrowing and now we're going to multiply that by this fraction above. But we need to know what (r) is. So we're going to have 0.065 divided by 12 that's our (r), if you remember, this is our interest rate divided by 12. Now our (r) would be 0.005417 that's rounded.

Then we add (1 + r) which is 0.065 over 12 and then we raise that to the n'th power. The n'th power is 30 multiplied by 12. So this is going to be to the 360th power.

Now in our denominator the bottom part of our fraction, we're going to have (1 + 0.65 divided by 12) to the 360th power that's that (n) again and then we're going to subtract 1.

So you can put this into Excel or if you have a graphing calculator you'll be put it in and you just take the 100,000 and then you multiply it by this big fraction. Now we are going to have a monthly payment of $632. So we're gonna have a monthly payment of $632, that's going to be our monthly mortgage payment, and again just to just a note here you're paying this on a monthly basis.