In this article, we're going to discuss the effect of an import tariff on a country's total surplus and I'm going to show you with a graph how it leads to a deadweight loss.

Table of Content

Understanding the Market (Without Trade & Tariff)

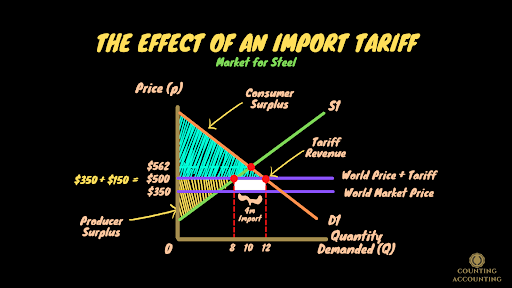

So let's take the market for steel production in the United States and so let's say that the equilibrium price of steel is $562 and the equilibrium quantity is 10 million tonnes if we're just looking at the market for steel in the U.S. supply and demand in the U.S. without any kind of international trade any tariffs anything like that. Now we've got our consumer surplus and our producer surplus. Let's say that the world price of steel is $350 a tonne, that's cheaper than the equilibrium price in the U.S. so the U.S. is going to be a net importer of steel. It is going to import steel so I'm going to show you now how it changes when the U.S. only imports steel.

Understanding the Market (With Trade)

So with trade and still we haven't introduced tariffs yet I just want to show you when we introduce trade we see that the consumer surplus is going to expand a lot because of the world price. We've got the world price of steel it's $350 and so now the consumer surplus expands and the consumer surplus together shifts from producers to consumers and so producers are worse off but consumers are better off but there's also this new triangle under the supply curve and over the world price line, with a trade that is an increase in the total surplus. So the U.S. is better off importing with trade because it's the demand at this point exceeds the supply in terms of the U.S. producers, how much steel they're willing to produce? They're only willing to produce 4 million tonnes but the consumers are demanding 16 million tonnes. So we have 12 million imports.

Understanding the Market (With Trade & Tariff)

Now I want to show you what happens when we introduce an import tariff. Let's just say for example that the U.S. said "We don't like importing steel for whatever reason, maybe these producers are being hurt." Even though the U.S. is better off because it's getting a larger total surplus section producers have a strong incentive to complain and say "We're having people are being fired and where our profits are being eroded and so forth." We can certainly understand where they would take issue even though as a whole the u.s. is better off from trade. So let's say there's an import tariff of $150 a tonne on steel. So what that is effectively going to do is it's going to raise the cost of steel in the U.S. instead of it being where that you can get it at the world price of $350 a tonne now we all have a price of $500 this is the (world price + the tariff). So if someone in the U.S. wanted to buy steel from the world market it's not only gonna cost $350 but now I also have this import tariff of $150 so the real price is $500 dollars a tonne. In that $500 that's just the $350 world price plus the $150 tariffs.

Effect of Trade & Tariff in the Market

So what is going to happen is before we had a whole triangle of consumer surplus which was in blue color but now you could see that this triangle is smaller than that triangle we have seen before. So consumers are worse off but now producers, U.S. producers of steel they're going to get some part from our consumer's triangle. So that is the producer surplus, now you see that the Yellow triangle is larger so the producers when they trad before they were shrunk to that tiny triangle that we have seen before but now they have captured some of the value that consumers used to get. So they're benefiting because obviously now there's going to be more steel purchase from producers in the U.S. because become more expensive to buy on the world market because of this tariff. So producers are gaining but they're gaining from consumers so it's a transfer from consumers of the U.S. to producers of the U.S. so that doesn't help, that doesn't affect the total surplus.

Now you might be wondering what about this area here? Note that was actually part of the total surplus. Well, a couple thing is going to happen, so we went from 8 million to 12 million I'm just making these numbers up to show you but that difference is (12 - 8) that's 4 million imports and before that, we had 12 million imports so this amount here this white square that is revenue from the tariff.

So this is tariff revenue for the federal government. So the US government imposes tariffs and so they're getting revenue from the tariff so this tariff revenue goes to the U.S. government. The tariff is $150 dollars because it's just the difference between $500 and $350. That 150 times 4 million which is the number of imports. That would be the revenue raised from the tariff.

Deadweight Loss

Now we have something else though, see that red triangle here? tiny little triangle and then there's also a red triangle. So those two red triangles are deadweight losses. Each of them is a deadweight loss and if you're wondering what a deadweight loss is, think of it like this it's a reduction in the total surplus. The deadweight loss is a reduction in the total surplus. When we introduced free trade before we had any trade at all we had an increase in the total surplus. Total surplus is consumer surplus + producer surplus we had that whole blue triangle that was an increase in total surplus but now we lost this white area, now the white part is the government's revenue. So maybe the government does some great things with that, that depends on your opinions on how the government spends money but the red triangles they used to be part of this total surplus and now they're gone, they're not consumer surplus they're not producer surplus they're not surplus for anybody. So they are a reduction in the total surplus.

So even if you're fine with the notion of "The government's getting this revenue and maybe a little spend it to provide and job training programs or something like that." even if you're cool with that we're still worse off with the tariffs. The U.S. if we're just thinking I'm not even thinking now hear about other countries that would be selling steel or something like that to us, forget all that just thinking about the U.S. there is a reduction in the total surplus of the U.S. because of these red triangles. These two red triangles used to be part of the surplus they were actually consumer surplus and now they're gone.

So you might be thinking hey if this decreases the total surplus then why would any government ever impose the tariff? Well look at the producers, the producer surplus increases, so steel producers in the U.S. would have a strong incentive to say "Listen we're being hurt by these are competition from steel producers in other countries we need this tariff to protect our domestic industry, our steel industry to save American jobs and so forth." but when we think about it on the net basis we don't care just about producer surplus we also care about consumer surplus and on a net basis we're actually reducing our total surplus with the tariff because although producers are being made better off because the expense of U.S. consumers but the U.S. as a whole is worse off because of the tariffs.