What are the differences between a career in accounting and a career in finance? This is the topic of this article the good news is that the job market for accounting and finance is expected to grow at a pace of about 6% annually for the next 10 years and so this is an exciting time for you to get into accounting and finance and grow your career.

Now let's get into the differences between accounting and finance as a career.

Difference #1

Has to do with the goal, what's the goal of a financial accountant versus the goal of a financial analyst? The goal of the accountant is to get the data in and create financial statements and so the accountant is concerned with gathering the transactions of the business and creating financial statements as opposed to the goal of a financial analyst which is to analyze this data and look at it from this point in time forward and project out the performance of the business.

Difference #2

is the nature of the work so the accountant's work by definition or by nature is looking at the past at the history and gathering the financial data and information and summarizing that into financial statements. Now the financial analyst is concerned with the future, so they are always looking at this point in time going forward and forecasting the performance of the business.

Difference #3

has to do with the risk. What risk is the accountant trying to mitigate all the time and concern with all the time is a risk of material misstatement. That is the financial statements that the accountant is producing have a material misstatement or error this is opposed to the risk that the financial analyst is dealing with, which is the risk between a variance between what they are projecting for the future and reality. So our financial analyst is always making assumptions about the future and the risk here is that some of these assumptions may be wrong.

Difference #4

Between an accountant and a financial analyst has to do with the type of problems you're trying to solve. Typically an accountant is trying to solve problems around accruals, revenue recognition, making sure the accrues for expenses that have not yet impacted the cash balance but the service has been incurred or booking revenue in the right period and just generally following US GAAP which is generally accepted accounting principles.

Now the kind of problems the financial analyst will be dealing with modeling and creating assumptions about the future such as seasonality, customer behavior, and customer loss or churn in the future.

Difference #5

has to do with compensation. In the u.s. in 2019 the median salary for an accountant was 71 thousand dollars a year which is not too bad compared to a financial analyst which had a median salary of 86 thousand dollars a year and so as you can see there's about a $15,000 gap which is about 15 to 20 percent difference between accountants and financial analysts.

Difference #6

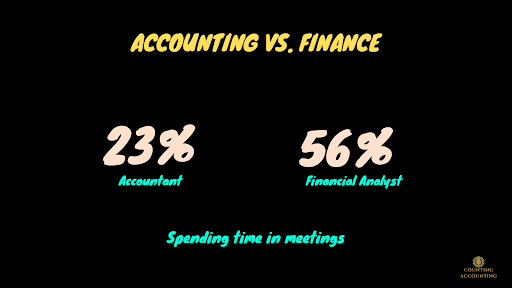

Let's look at the day in the life of an accountant versus a day in the life of a financial analyst. I think the best way is to look at a month in life versus a day in life because a month will give you a better view of what's going on in each of their professions. For the accountant, their months usually begins with the first 7 days of trying to close the period and so that will entail billing going over invoices from vendors making sure we're booking all of the expenses even though we have not received the vendor invoice yet accruing for these expenses and things like that and that will entail having meetings with within the accountant team and the meetings probably you spend the 25% of your time in meetings trying to close the books and trying to make sure you're following all the rules comparing period over the period in terms of expenses and revenue to make sure you're catching any anomalies.

Now if you compare that to the month in the life of a financial analyst you'll see that a financial analyst spends maybe about 56% to 60% of their time in meetings and their meetings are different the accountant's meetings are usually internal their bidding within the accounting team most of the time, for the financial analyst most of the time they're meeting with other people within the company from the sales team to go over revenue forecasts and assumptions or meeting with the operation team and trying to capture the forecasts for expenses and things like that.

Now there are three reasons for me to choose accounting over finance as a career.

The first of which is my own personality as an introvert and so I interact with my smaller accounting team most of the time and I interact with the larger group and the company from revenue and operations on a smaller scale so most of the time I'm just interacting with five or six people within my own team and I spend a small amount of time interacting with the rest of the company and that suits my personality more. As an introvert, I think that finance suits more an extrovert type personality where you'll be spending most of your time interacting with people from all around the company.

Now the second reason for me to choose accounting was that it's rule-based and so when it's rule-based I have a set of rules to follow and I know what I'm doing it exactly. so I have rules which are for accounting its US GAAP. Which is in the u.s. generally accepted accounting principles and as long as I'm operating within these rules I know that I'm doing the right thing and there's no ambiguity. It's mostly black and white, there's a little bit of gray but mostly black and white and so this is what I enjoy the most and that's why I chose accounting.

Now the third reason for me to choose accounting over finance has to do with the stress level. I believe that the stress level from working in accounting is lower than in finance. The reason being is that you are concerned with two things in accounting which is accuracy and timeliness and as long as you're accurate in financials that your reporting and the timing of these of the reporting you will be fine whereas in finance there are other factors from outside that can impact your work. Because you're always making assumptions about the future and these assumptions may change and so there will be a variance between your projection and reality.

So I hope this article gives you a good overview and the differences between a career in accounting and a career in finance.

Tags:

Job Analysis