In this article, we're gonna talk about a firm's enterprise value. First of all, what do we mean by enterprise value? We're talking about the overall market value of the entire firm. so you might say "Ok can't we just look at the stock price to calculate it?" Well, we have to think about this for a minute. Let's take the firm consists of assets it has machines, it has accounts receiveable, it has inventory, It has all these different assets, right? But remember that there are claims against those assets and those claims are from a couple groups who are you have debt holders for example banks might have some claim against those assets for funds that they've lend to the firm and then you also have equity.

The owners and their share the residual claim against these assets. So when we think about the entire firm the overall firm we think about its value what we want to think about? Kind of conceptually here is what would be the takeover price if we wanted to satisfy to get rid of all those claims and it'd just be entirely our firm that we've completely taken over.

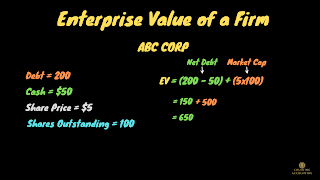

To do that we have to take into consideration the value of the debt and the value of the equity in calculating this enterprise value. So what's the equation well the enterprise value is going to be the net debt and I'm going to talk about why it's net in a moment the net debt we're gonna add to the market value of the firm's equity.

Okay so let's think about this so the debt what we're doing, we're going to actually take the firm's book value of its debt which might seem odd, you might be thinking well I thought we were talking about market value here. Well, every time usually in many cases very difficult to figure out what exactly the market value of a firm's debt actually is. So we're just going to go ahead and take the book value of debt and then we're going to subtract out cash because if you are taking over the firm obviously you're getting this cash.

So really when we think of a firm's debt we can think of it net of cash that could obviously be used to satisfy and pay down that debt. So we're just going to think of net debt for this debt component of the claims against the firm's assets and then we're going to think about the equity side we've got to have the market value of the firm's equity otherwise known as the market capital, right?

We call it the market capitalization and all that is going to be is the firm's share price times the number of shares outstanding

ABC Corp make polymer-based products and so ABC Corp we take a look at their financial statements and we see that they have some debt and we just look at the balance sheet we see that the book value of this debt is 200 and then the share price, we need to know the share price which is $5 a share and then we have the number of shares outstanding, right? We need to know the share price and the shares outstanding in order to calculate the market cap that we talked about and let's say that there are 100 shares outstanding for this firm and then let's say that the firm has cash of $50

Okay so for this ABC Corp how will we calculate the actual enterprise value from this for this firm? So say EV the enterprise value is your going to be equal to the net debt which in this case 200 and then we're gonna subtract out the $50 cash, right? So then what we're gonna do is we're gonna add to that net debt we're gonna add the market value of the firm's equity not the book value of equity the market value of the equity which is going to be 5 the share price times 100 which is the number of shares outstanding and then when we go ahead and we calculate this out we get 150 plus 500 ultimately our enterprise value is going to be 650.

Now you might be saying "Well maybe I'm not really interested in taking over an entire firm or something in the debt and the equity and I just want to know what is this job practically useful for. I want to do some valuation or interest in finance what do I care about this EV value?"

Well EV is commonly used in multiples when we think about multiple analysis and what we're talking about with multiples is, we can take something like EV over EBITDA. All alright this is a multiple and if we're trying to value a firm if we're trying to say okay what's the EV of some firm? Maybe the firm is about to be issued as an IPO or for whatever reason, we're trying to estimate what the EV is or what it's likely to be for a firm.

We can go ahead and say like "Let's take a look at the EV over EBITDA multiples for other firms in that industry" and let's say that the average EV over EBITDA for the industry it's 6 and now if we know the EBITDA for the firm that we're trying to calculate the EV if we know that the EBITDA for this firm let's say that's "X" or it's a 100 or whatever then we can go ahead and we can calculate the enterprise value based on the EBITDA.